(a) Electricity furnished for all purposes or uses and measured through one (1) meter and using single or three phase electrical power or a combination of both, shall be supplied at the following rates for all electricity used per electric rate schedule as follows:

RESIDENTIAL ELECTRIC RATE SCHEDULE

The rate per KWH for all residential meters shall be $0.10 per KWH.

COMMERCIAL ELECTRIC RATE SCHEDULE

The following rate schedule shall apply to all non-residential meters to include, but not limited to, the customers in the following customer categories: churches, schools, industrial, commercial, and governmental.

First 575 KWH used per billing period $0.10 KWH

All KWH above 575 KWH $0.08 KWH

(b) The monthly service charge, where only single phase is used through one meter, shall be $4.50 per month.

(c) The monthly service charge, where only three phase power is used or a combination of single phase and three phase power is used through one meter shall be $10 per month.

(d) As a condition of providing electric service, where it is necessary to make an unusual extension or expansion of the existing distribution system to provide service that in the judgement of the city, revenues will not be adequate to justify the expansion under stated rate schedules, the city may require by contract a minimum billing or demand charge sufficient to amortize the expansion.

(e) After each billing period, the city clerk shall compensate the electric fund capital fund $0.004 per net billed kWh and the economic development fund $0.002 per net billed kWh. Expenditure from each fund may only be made upon approval by the city council.

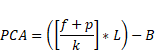

(f) The energy charge in rate schedules to which this adjustment applies will be increased by $0.0001 per kilowatt-hour (kWh) for each $0.0001, or major fraction thereof increase in the aggregate cost of fuel and purchased power per kWh as computed by the following Production Cost Adjustment (PCA) formula:

PRODUCTION COST ADJUSTMENT

Where:

f = Cost of fossil fuel used for generation during the current month.

p = Cost of power purchased during the current month.

k = Net kWh generation (gross generation less plant use) and kWh purchased during the current month.

L = Loss factor of 1.125 to account for distribution losses and energy furnished free by the utility to the city.

B = Base rate of $0.0390 per kWh.

The monthly PCA will be applied to those customer bills issued immediately following the month for which the PCA is computed. The city may authorize the use of estimated fuel and purchased power costs in the PCA when needed to protect the financial condition of the utility or to more fairly apportion PCA cost recovery among customers. Any over or under recovery of costs resulting from the use of estimates Will be included in a subsequent PCA calculation. Application of the PCA for any month is at the option of the city.

(Ord. 9407, Sec. 1; Ord. 9711; Ord. 9809; Ord. 2001-4; Ord. 2007-3; Code 2022)

Florescent lights or other low power factor equipment shall be provided with capacitors by the customer. Use of electrical apparatus or devices causing objectionable fluctuations of voltage and disturbance of service to others will not be permitted.

(Ord. 8102, Sec. 2)

That from and after the meter reading date for all electric customers being supplied electricity by the city, being September 12, 1976, the city clerk shall report monthly to the governing body the total cost of al fuels used for the generation of electricity by the city beginning with the fuels used during the month of September, 1976.

The governing body shall determine each month and record the same in its official minutes the amount of fuel costs adjustment to be added to all electric bills each month for the increased cost of all fuels used for the generation of electricity. The cost of all fuels used for the generation of electricity during the month of August 1976, shall be and is hereby established as the base period for the calculation of the fuel cost adjustment. The fuel costs adjustment rate shall be expressed on each electric bill as a factor per kilowatt hour (KWH) for all electricity consumed by each customer.

(Ord. 12-200, Sec. 5)

(a) District shall consist of not less than one municipal block. A district may be comprised of more than one block so long as the district does not consist of a portion of a block.

(b) Petition: A petition may be submitted by 80% of the property owners of the district to place utilities underground. Upon presentation of the petition signed and approved by 80% of the property owners, the city shall have the authority to require all utilities to be placed underground.

(c) Utilities: Utilities shall include but not be limited to electrical transmission lines, communications and telephone lines, cable television lines, and any other overhead lines or power lines.

(Ord. 8508, Sec. 3)

Utility lines shall be required to be placed underground by the owner of the real estate. The owner shall make the necessary arrangements for the installation of whatever facilities are necessary for the underground placement. The lines shall be placed within easements or right-of-ways in a manner which will not conflict with other underground services. For the purpose of this section, appurtenances and associated equipment such as, but not limited to, terminal boxes and meter cabinets, in an underground system may be placed above ground. The location of such facilities in the public right-of-way shall be subject to the approval of the city. The city may waive the requirements of this section if topographical, soil, or any other conditions made such underground installations unreasonable or impractical. This shall not apply to utility lines which do not provide a service to the subject area.

(Ord. 8508, Sec. 4)

(a) All bills for electricity consumed shall be dated the first day of the month following the meter reading date, be due when received, and be payable at the city offices on or before the 16th day of the month following the billing date. Any bill not paid on or before the 16th day shall be subject to a late payment charge added to the net amount due shown on the bill. The late payment charge added to the net amount due shown on the bill. The late payment charge shall be equal to 6% of the net amount due. Any customer who fails to pay in full the bill due for electric service before the time specified in a notice mailed to such customer after the 16th day giving notice that electric service will be discontinued if the bill is not paid by the time specified therein; then the electric service shall be discontinued for nonpayment of the bill due.

(b) Whenever it is necessary to discontinue electric service because of nonpayment of any bill due, one of the following charges shall be added to the bill due for the cost of turning off the electric service; to-wit:

(1) If service is discontinued at the electric meter location, the turn off fee shall be $5; or

(2) If it becomes necessary to discontinue the service at the point of connection of the service line serving the premises and the city’s electric distribution system by cutting the service line, the turn off fee shall be $20.

(c) When a customer pays any bill due for electric service that was discontinued for nonpayment, one of the following charges shall be added to the bill due for the cost of turning on or reconnecting the electric service; to wit:

(1) If service was discontinued at the electric meter location, the turn on fee shall be $5 when electric service is turned on during normal business hours; or $10 when electric service is turned on after normal business hours; or

(2) If it was necessary to discontinue service by cutting the service line at the point of its connection with the city’s electric distribution system, the reconnection fee shall be $20.

(d) This section shall not obligate the landowner or any new resident or customer to pay the unpaid bill owing by any other individual even through the bill may have been incurred at the premises for which new service has been requested.

(Ord. 8009, Sec. 1; Ord. 8512, Sec. 1)

(a) There is hereby adopted Interconnection Standards for Installation and Parallel Operation of Customer-Owned Residential and Commercial Renewable Generation Facilities, together with the Net Metering/Parallel Generation Rate Rider for Customer-Owned Renewable Energy Generation Facilities including all attachments, all as attached to Ordinance No. 2019-7 and marked Exhibit “A”, incorporated by reference herein, and made a part of this section.

(b) The adopted Interconnection Standards for Installation and Parallel Operation of Customer-Owned Residential and Commercial Renewable Generation Facilities and Net Metering/Parallel Generation Rate Rider for Customer-Owned Renewable Energy Generation Facilities marked Exhibit “A” may be amended and modified in whole or in part by the Governing Body of the City of Ellinwood, Kansas, as deemed appropriate by the Governing Body.

(Ord. 2009-11; Ord. 2019-7; Code 2022)

(a) Parallel Generation Charges. (i) Any residential customer of the City’s electric utility that installs an energy producing system or renewable generator with a capacity of 25 kilowatts or less, or (ii) any commercial customer of the City’s electric utility that installs an energy producing system or renewable generator with a capacity of 200 kilowatts or less may, upon request of such customer, enter into a contract with the City for parallel generation whereby such customer may attach or connect to the City’s delivery and metering system an apparatus or device for the purpose of feeding excess electrical power which is generated by such customer’s energy producing system into the City’s electrical system and compensation therefore. Such contract shall comply with the requirements of K.S.A. 66-1,184 et seq., as amended. The cost of any equipment required to be installed for such attachment or metering and installation shall be the sole responsibility of the customer and such equipment shall not cause damage to the city’s electric system or equipment or present and undue hazard to City personnel.

In addition to all other electric charges, any customer that has entered into a contract with the City pursuant to this subsection shall pay a monthly parallel generation charge calculated as Average Monthly Renewable Energy times Unrecovered Energy Revenue less Avoided Demand times the Capacity Demand Rate (i.e.,) (Average Monthly Renewable Energy x Unrecovered Energy Revenue) - (Avoided Demand x Capacity Demand Rate). The calculations are more fully set forth on Attachment “A”.

Any customer who has entered into a contract with the City shall install a meter, provided by the City, to their energy producing system or renewable generator. The City shall re-evaluate the customer’s monthly parallel generation charge on the 1st of June following the first twelve (12) months after approved installation and then on the 1st day of June each year thereafter during the term of the contract.

(b) Definitions. The following definitions shall apply to this Section:

(1) Annual Electric Sales means the total amount of electricity in kWh sold by the City in the previous fiscal year.

(2) Annual Energy Production means the annual energy production of the customer’s energy producing system according to the National Renewable Energy Laboratory.

(3) Annual Energy Rate means the Annual Energy Rate of the KPP as reported on the corresponding monthly invoice.

(4) Average Monthly Renewable Energy means Annual Energy Production/12.

(5) Average Revenue per kWh means Revenue from Energy Charges/Annual Electric Sales.

(6) Avoided Demand means 35% of the Capacity Demand Rate.

(7) Capacity Demand Rate means the capacity demand rate of the KPP as reported on the corresponding monthly invoice.

(8) KPP means The Kansas Power Pool (“KPP”), a Municipal Energy Agency.

(9) Miscellaneous Energy Costs means any generation fuel costs incurred by the City and not recovered from the KPP.

(10) Revenue from Customer Charge means the total revenue of the City from all electricity customer charges in the prior fiscal year.

(11) Revenue from Demand Charges means the total revenue of the City from all electricity demand charges in the prior fiscal year.

(12) Revenue from Electric Operations means the total revenue of the City from all electric operations in the prior fiscal year.

(13) Revenue from Energy Charges means Revenue from Electric Operations - Revenue from Customer Charges - Revenue from Demand Charges.

(14) Unrecovered Energy Revenue means Average Revenue Per kWh - Annual Energy Rate (Annual Energy Production/Annual Electric Sales).

(Ord. 2019-6; Code 2022)